Gold as a Hedge Against Inflation

Resources

|

Posted 25/09/2023

|

424

As global inflation concerns persist, savvy investors are increasingly turning to gold as a reliable hedge against rising prices. Gold has long held its reputation as a safe haven asset during times of economic uncertainty, and it has consistently proven its worth as a hedge against inflation.

Understanding Inflation's Impact

Inflation occurs when the cost of goods and services steadily rises over time, eroding the purchasing power of fiat currency. Various factors can contribute to inflation, including increased demand for goods and services, disruptions in supply chains, and government policies that expand the money supply. Inflation can have significant implications for investments, especially those denominated in fiat currency.

Inflation can have a significant impact on the cost of living, affecting individuals and households in various ways. Here's how inflation affects the cost of living:

Rising Prices

Inflation causes the general price level of goods and services in an economy to increase over time. This means that consumers will need to pay more for the same goods and services they were buying at lower prices in the past. This rise in prices can directly impact the cost of living because everyday expenses become more expensive.

Reduced Purchasing Power

Inflation erodes the purchasing power of money. When prices rise faster than people's incomes, the real value of their money decreases. As a result, consumers may find it more challenging to afford the same standard of living they once enjoyed. They may have to allocate more of their income to cover essential expenses, leaving less for savings or discretionary spending.

Impact on Essential Goods and Services

Inflation can hit essential items like food, housing, healthcare, and transportation particularly hard. These are the basic necessities of life, and when their prices rise significantly, households may have to make difficult choices or cut back on other discretionary spending to make ends meet.

Interest Rates and Debt

Central banks often raise interest rates to combat high inflation. While this can help control inflation, it also means that borrowing becomes more expensive. People with variable-rate loans, such as adjustable-rate mortgages or credit card debt, may see their monthly payments increase, adding to their financial burden.

Savings and Investments

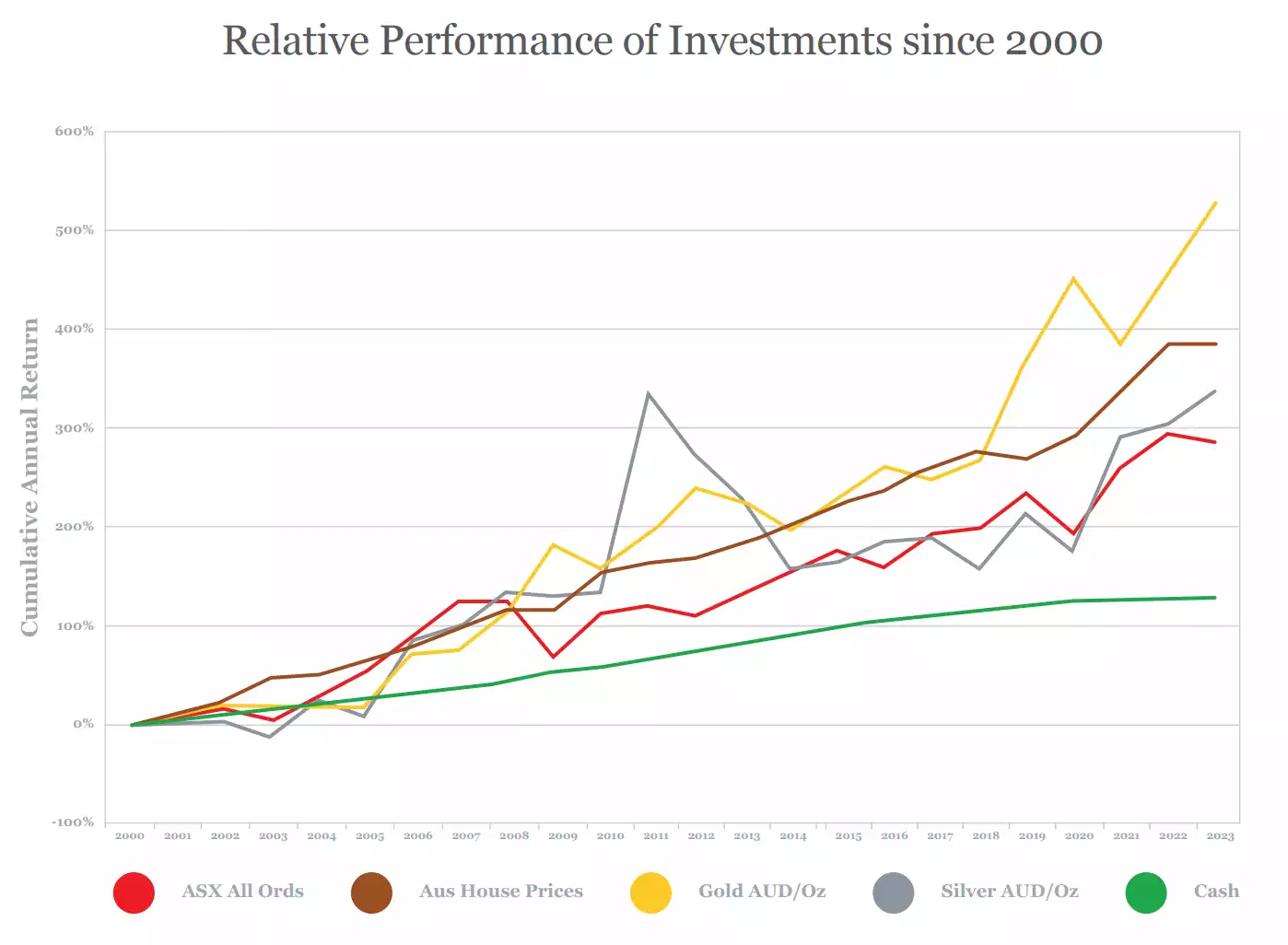

Inflation can erode the real return on savings and investments. If the return on savings or investments does not keep pace with inflation, the purchasing power of those savings diminishes over time as the power of the Australian dollar is reduced. This can make it more challenging for individuals to achieve their financial goals, such as saving for retirement or a major purchase.

Wage Increases

While inflation can lead to rising prices, it can also put upward pressure on wages. Employers may increase wages to help employees maintain their standard of living in the face of rising costs. However, there can be a lag between rising prices and wage increases, meaning that some workers may initially feel the squeeze of inflation.

Fixed-Income and Retirees

Fixed-income individuals, such as retirees living on pensions or fixed annuities, can be particularly vulnerable to the effects of inflation. If their income remains constant while prices rise, their purchasing power diminishes, potentially impacting their ability to cover essential expenses.

Social Programs

Inflation can put pressure on government social programs like Social Security and welfare. To ensure that these programs provide an adequate safety net for recipients, governments may need to adjust benefit levels to account for rising living costs.

Consumer Behaviour

In response to inflation, consumers may change their spending habits. They may cut back on non-essential purchases, look for discounts and deals, or seek alternative, lower-cost products or services.

Why Gold Shines as an Inflation Hedge

Gold bullion stands out as an effective hedge against inflation due to its unique properties. Unlike fiat currency, gold has a limited supply and cannot be printed or created at will. Consequently, gold maintains its intrinsic value over time, making it a reliable store of wealth. History provides ample evidence of gold's effectiveness as an inflation hedge, with gold consistently outperforming inflation and preserving purchasing power.

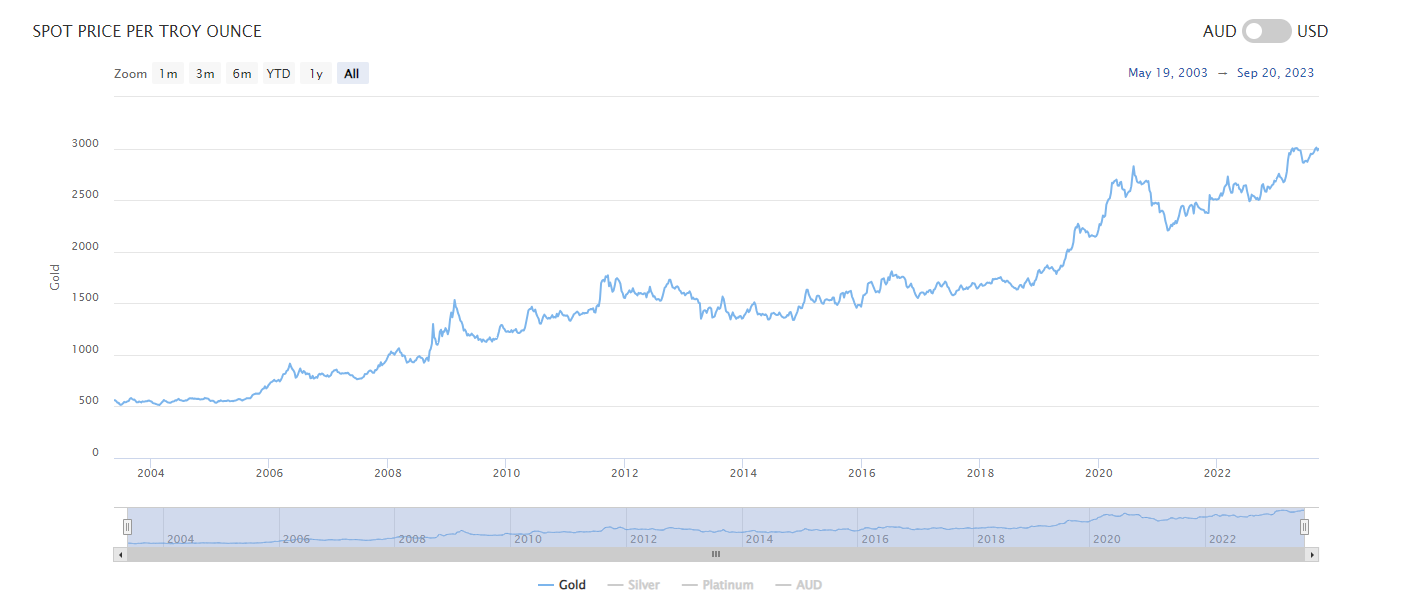

Recent Evidence: Gold in Australian Dollars

In recent times, the price of gold in Australian dollars has surged due to mounting inflation concerns stemming from unprecedented money printing. This trend underscores physicals gold's enduring appeal as an inflation hedge and a store of value.

Gold Price Historical Performance: Key Moments

Let's explore some specific historical periods that showcase the role of gold bullion as a dependable hedge against inflation.

The 1970s Inflationary Period

The 1970s were marked by significant economic turbulence, characterized by soaring inflation rates and uncertainty. This era serves as a compelling case study of gold's effectiveness as an inflation hedge.

Economic Landscape: The 1970s were marred by two substantial oil price shocks in 1973 and 1979, causing a rapid rise in energy costs and a subsequent increase in the prices of goods and services. Loose monetary policies, especially in the United States, further fuelled inflation.

Gold Price Performance: In this inflationary environment, gold proved to be a reliable store of value. Gold, which started the decade at $35 per ounce, witnessed a remarkable surge, as the gold price reached over $800 per ounce by the decade's end. This staggering increase significantly outpaced the rate of inflation, safeguarding investors' wealth.

End of the Gold Standard: The 1970s also saw the demise of the gold standard in various countries, including the United States. The abandonment of fixed-value gold-to-dollar conversions further bolstered the appeal of physical gold as a store of value.

The Global Financial Crisis (2008)

The Global Financial Crisis of 2008 was a pivotal moment in modern economic history, showcasing gold's performance as an investment during times of economic uncertainty.

Economic Landscape: Triggered by the U.S. housing market collapse, the crisis led to a global banking catastrophe and widespread fear in financial markets. Central banks worldwide responded with unprecedented monetary easing measures, increasing the money supply to stimulate economic activity.

Gold Price Performance: Gold once again demonstrated its worth as a safe-haven asset. Amid the crisis, investors started to buy gold, and despite some volatility, it ended the year around $850 per ounce. However, it was in the aftermath of the crisis that gold truly shone. As central banks embarked on quantitative easing, fears of future inflation emerged. Investors continued to flock to the yellow precious metal, driving the gold prices to new highs, exceeding $1,900 per ounce by 2011.

The COVID-19 Pandemic (2020 - Present)

The COVID-19 pandemic has brought significant economic disruption and prompted governments and central banks to implement extensive fiscal and monetary measures, raising concerns about inflation.

Economic Landscape: The pandemic caused severe recessions in many countries. Governments and central banks deployed massive stimulus measures, leading to increased money supply and potential inflationary pressures.

Gold Price Performance: Once again, gold emerged as a reliable store of value amid economic turmoil. As the pandemic unfolded in 2020, investors sought refuge in gold, driving up its price. In Australian dollars, gold reached historic highs, peaking at over $2,800 per ounce in August 2020. Gold has maintained its strong performance, reflecting ongoing investor demand amid economic uncertainty and inflation concerns.

The Role of Gold in Uncertain Times

The COVID-19 pandemic underscores gold's importance in a diversified investment portfolio. In an era of unprecedented economic uncertainty, gold offers stability and protection against potential inflation. As investors worldwide turn to this timeless asset, gold today continues to shine brightly as the king of the precious metals when considering a hedge against current volatile market conditions.

Conclusion

In times of rising inflation and economic turbulence, gold has consistently proven itself as a reliable hedge and a store of value. Its historical performance during periods of inflation, such as the 1970s, the Global Financial Crisis, and the COVID-19 pandemic, underscores its enduring appeal for investors seeking stability and protection against eroding purchasing power. As the world grapples with economic uncertainties, gold bullion stands strong as a beacon of financial security.